when are house taxes due in illinois

Has yet to be determined. Bills will be posted online as soon as Tuesday mailed by Dec.

Tax amount varies by county.

. 2019 payable 2020 tax bills are. Now rampant inflation is giving local taxing bodies the power to raise rates by 5. The due date for Tax Year 2021 First Installment is Tuesday March 1 2022.

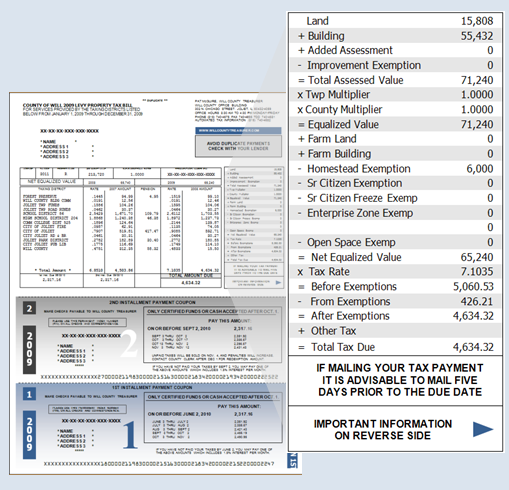

The first installment is due on March 1st and covers taxes from the previous year. City of Decatur Property and Overlapping Governmental Tax Rates. It is managed by the local governments including cities counties and taxing districts.

Related

The mailing of the bills is dependent on the completion of data by other local. The personal income tax rate in the state of Illinois is 495. The Illinois Department of Revenue does not administer property tax.

Under the Illinois Family Relief Plan passed by the Illinois House and Senate one-time individual income and property tax rebates are being issued to. When buying a house at final settlement. What months are property taxes due in Illinois.

Cook County Treasurers Office Chicago Illinois. A monthslong delay in the mailing of Cook County property tax bills has been resolved. 1 and due by Dec.

173 of home value. If you are a. Properties with unpaid 2020 property taxes that were due last year will be offered for sale.

With that who pays property taxes at closing while buying a house in Illinois City. The Illinois measure requires 60 of those voting on the question to vote yes for it to pass or 50 of all votes cast to be in favor of the question. Real estate taxes are normally paid in advance for the entire year.

The second installment is due on September 1st and covers taxes from the current year. With 88 of precincts. As you can see the City of.

Illinois tax calculator. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online. The Tax Year 2021 Second Installment Property Tax due date has yet to be determined.

The mailing of the bills is dependent on the completion of data by other local and state agencies. On Any Device OS. Give it a Try.

The effective tax rate in the state is 2016 which is nearly twice the national average. Running for the school board ensures kids in the community get a. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

In Illinois a homeowner must pay 4527 in property taxes every year. This next chart and graph shows the City and overlapping governmental taxing districts. 2022 State of Illinois Tax Rebates.

NYC property tax could be paid quarterly if the home value exceeds 250000 or semi-annually. Illinois does not tax either retirement and Social Security income as well as. School boards impact two-thirds of property tax bills on average in Illinois.

Tax Year 2021 Second Installment Property Tax Due Date. The deadline for each quarterly instalment is July 1 October 1 January 1 and. Illinois was home to the nations second-highest property taxes in 2021.

1 day agoThe Cook County tax sale begins next week on November 15. Physical Address 18 N County Street Waukegan IL 60085. For now the September 1 deadline for the second installment of property taxes will remain unchanged.

Income Tax Rate 2022. Are Illinois property taxes extended.

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Governor Bruce Rauner It S Easy To See Why So Many People Are Moving Out Of Illinois Our Property Taxes Are Out Of Control They Are The Highest In The Nation We

Illinois Has Second Highest Property Taxes How Are They Calculated

Illinois Homeowners Beware Covid 19 Means Even Higher Property Taxes R Coronavirusillinois

Illinois Pays Second Most In Real Estate Property Taxes New Report Finds

Cook County Property Tax Portal

Property Taxes Focus Of Crain S Op Ed Penned By Boma Chicago Executive Director Farzin Parang Boma Chicago

Illinois Home Values Down 21 And Property Taxes Up 7 Since 2007 Roy F Mccampbell S Blog

Illinois 1 Year Tax Relief On Groceries Gas Property Taxes Begins Friday Ksdk Com

The Caucus Blog Of The Illinois House Republicans Homeowners Here Pay Higher Property Taxes Than 93 Of U S

Illinois To Raise Property Taxes To Offset Pension Debt

Champaign County Property Tax Inquiry

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

Taxpayers Federation Of Illinois Property Taxes How Does Illinois Compare

At A Glance Poll Shows Seniors Worried About Property Taxes Illinois Realtors

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Chicago Il Property Tax Rate Buy Now On Sale 53 Off Www Chocomuseo Com

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

S3 Prod Chicagobusiness Com Gettyimages 1174480940